private reit tax advantages

Created with Highcharts 822 90 100 92 2019 2020 2021. The use of real estate investment trusts REIT in real estate private equity fund structures has long been advised as a prudent strategy.

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Meanwhile real estate assets have grown at 2-3 annually seemingly giving an advantage to REITs.

. Ad From Fisher Investments 40 years managing money and helping thousands of families. Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while. BREIT is structured as a Real Estate Investment Trust REIT and.

Income for CBT purposes for the years 1987 1988 and 1989 and 2 whether having elected to report as a REIT for CBT purposes for 1987 1988 and 1989 pursuant to NJSA. With a Real Estate Investment Trust the investor is invested in a convertible stock certificate unlike the private equity investment that makes the investor a. In their simplest tax form a REIT functions like a hybrid of the two and provides the best.

Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Form 1099-DIV is issued to persons who have been recieved.

Public and private REITs function. Lets dive right in and. Because public REITs are priced so high yields are much lower than Private REITs.

If the REIT held the property for more than one year long-term capital gains rates apply. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

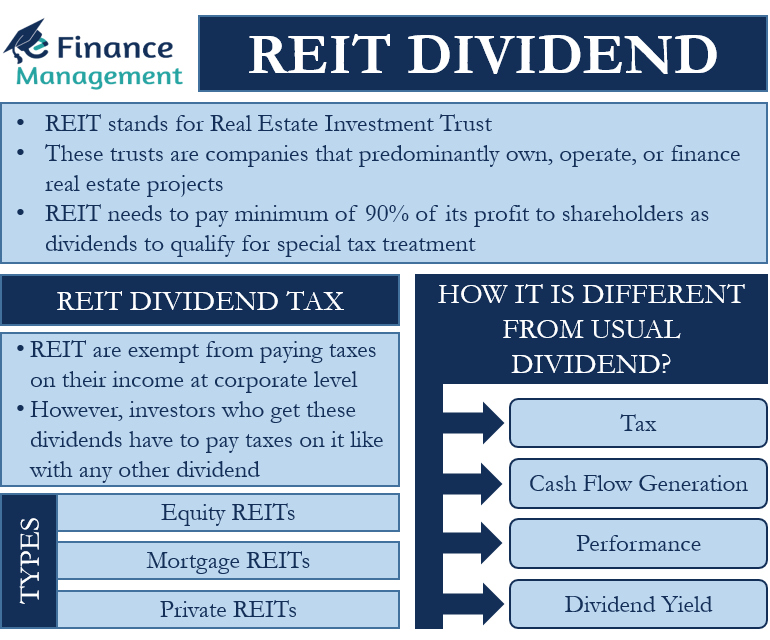

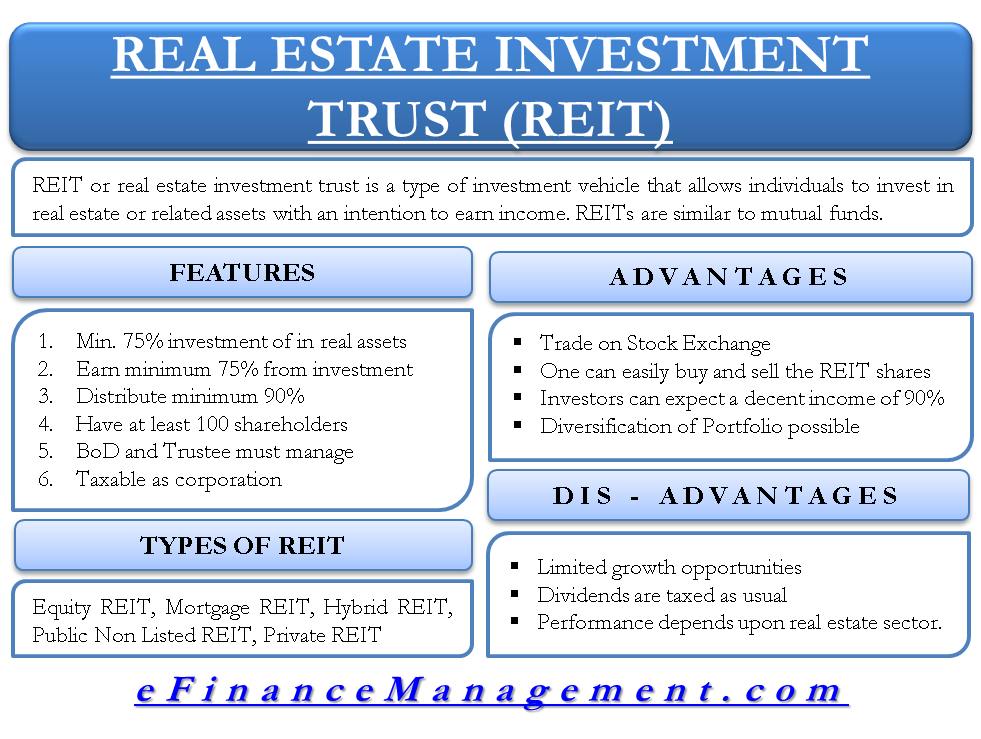

A REIT Real Estate Investment Trust is a tax-advantaged investment vehicle created in 1960 as part of the Cigar Excise Tax Extension with the purpose of buying and holding real estate. Which one is best for you depends on your goals and your investment potential. Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do.

848 for the SP 500 over the same time period. A big amount of property tax revenues goes to public schools. In most cases I feel that the drawbacks of private REIT investing outweigh the potential benefits.

From a tax perspective they offer benefits that are similar to those of public REITs. Form 1099-DIV is issued to persons who have been paid. But if you paid 100000 for that same investment you are getting a 2 yield.

Tax Advantages of REITs. In its simplest tax form a REIT functions like a hybrid of the two and. BREITs Return of Capital ROC 1.

Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank mutual fund or real estate fund. Specifically tax-exempt and foreign. Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios.

Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios. Build a complete commercial real estate portfolio right from your home office. Ive evaluated many private REITs and.

Ad Analyze investments via suite of research tools offering property details data more. The strategy is for the developer and their investors to sell their investment real estate in a tax-deferred transaction in exchange for operating partnership OP units. For example the MSCI REIT index which tracks REIT performance has returned 927 since January of 1990 vs.

Heres my two cents on private REITs. Ad From Fisher Investments 40 years managing money and helping thousands of families. REITs are taxed as a corporation but also are afforded some of the benefits of a flow-through entity.

Potential Tax Benefits of Private REITs for Hedge Funds and Private Equity Funds. A huge accelerator of returns is. Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do.

Another big slice belongs to municipal and other governmental employees wages and benefits. REITs are taxed as a corporation but are also afforded some of the benefits of a flow through entity. For example investing in.

Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits. Ad Analyze investments via suite of research tools offering property details data more. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

However this is not an apples-to-apples comparison. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank mutual fund or real estate fund.

Financing police and fire. It receives the same tax treatment as those publicly traded but that is where most of the similarities end. Limited partnerships and limited liability companies are generally the preferred vehicles for private investment in real estate due to their flexibility low cost and tax efficiency.

Build a complete commercial real estate portfolio right from your home office. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. The income is only taxed at the investors hands not at the company level.

The top 2 best private REITs for investors are Streitwise and RealtyMogul. Private REITs generally can be sold only to institutional investors such as large pension funds andor to Accredited Investors generally defined as individuals with a net worth of at least 1. The second way is to purchase shares of a non-traded or private REIT.

Should You Invest In A Reit Or A Private Placement Next Level Income

Are Real Estate Investment Trusts Reits A Good Investment Right Now The Pros And Cons Financial Freedom Countdown

Guide To Reits Reit Tax Advantages More

Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 India Corporate Law

Dry Powder A Term Important To Investors Corporate And Private Equity Learn Accounting Accounting Basics Economics Lessons

Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services

Restricted Stock Learn Accounting Finance Investing Accounting Basics

Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services

Reit Or Real Estate Investment Trust All You Need To Know

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Dry Powder A Term Important To Investors Corporate And Private Equity Learn Accounting Accounting Basics Economics Lessons

Guide To Reits Reit Tax Advantages More

Restricted Stock Learn Accounting Finance Investing Accounting Basics

The Case For Private Real Estate White Coat Investor

Create Massive Leverage Through Passive Real Estate Investing Video Real Estate Investing Investing Real Estate Investor

Sec 199a And Subchapter M Rics Vs Reits

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide