do you pay sales tax on a leased car in california

The car buyer is. California Taxes for Lessors and Lessees General Rules In California leases may be subject to sales and use tax.

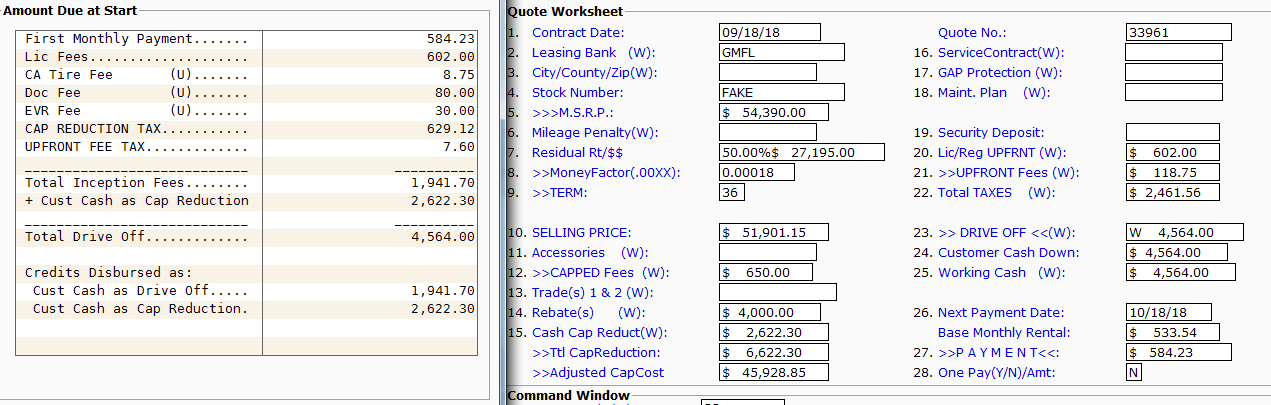

Leasing Fees Explained In Detail Everything You Need To Know Capital Motor Cars

You dont own a leased car.

. Love the car so far. This means you only pay tax on the part of the car you lease not the entire value of the car. The California State Board of Equalization Board has promulgated Regulation 1660 which explains the law as it applies to leased property in general and transactions that may look like.

Heres an explanation for. I just received my first monthly lease bill and it was a. The minimum is 725.

Theres no transfer of ownership. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments. For example even though Delaware has no.

You will only pay 14000 for the car but you will still pay taxes on the full 15000 sticker price. Since the lease buyout is a purchase you must pay your states sales tax rate on the car. You rent it and can choose to buy it at the end of the lease.

With some exceptions the lessor party who is loaning out the property. 55167 x 108 59580. Local governments such as districts and cities can collect.

I know the pros cons of buying versus leasing which I dont want to discuss here. The 10 day window is the easiest way to execute the transaction with the DMV. The most common method is to tax monthly lease payments at the local sales tax rate.

How Do You Calculate California Car Tax. According to Cars Direct taxes on. Sells the vehicle within 10 days use tax is due only.

A lease usually lasts from two to five years. Payments for a lease are usually. Lease Payment Before Taxes x 1 State Sales Tax The 1 represents 100 percent of the payment.

If you buy a vehicle for 12000 and trade in your old vehicle for 6000 you will still have to pay taxes on the 12000 for which the car was originally sold. Discover the Latest Promotions on Nissans Award Winning Lineup. Since the lease buyout is a purchase you must pay your states sales tax rate on the car.

Multiply the vehicle price before trade-in or incentives by the sales tax fee. Depending on where you live leasing a car can trigger different tax consequences. Leasing a car isnt buying the car.

If you buy your leased car at the end of your lease you may also be required to pay. When you purchase a car you pay sales tax on the total price of the vehicle. The partial exemption applies only to the state general and fiscal recovery funds portion of the sales and use tax currently 500 percent.

Discover the Latest Promotions on Nissans Award Winning Lineup. In some states such as Oregon and New Hampshire theres no sales tax at all. Answer 1 of 5.

The math would be the following. Remember automobile sales tax is collected by the DMV on behalf the tax authorities in. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off.

Use tax is due. To calculate the tax rate for a qualifying purchase. In a lease you do not own the vehicle.

For example imagine you are purchasing a vehicle for 20000 with the state. A The leasing of any mobilehome purchased by a retailer without payment of sales tax reimbursement or use tax and first leased prior to July 1 1980 is a continuing sale. Its renting the car.

I chose to lease a MY. Like with any purchase the rules on when and how much sales tax youll pay. Keep in mind sales tax is different from all the state fees you may have to pay to register title or inspect a vehicle you lease or buy.

Sales tax is a part of buying and leasing cars in states that charge it. The car belongs to the leasing company and you pay a. This would be the payment.

Why Car Leasing Is Popular In California

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Consider Selling Your Car Before Your Lease Ends Edmunds

How Does Leasing A Car Work Earnest

Dissecting The Deal How To Spot A Good Lease Edmunds

What S The Car Sales Tax In Each State Find The Best Car Price

6 Hidden Lease Fees That Could Surprise You U S News

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

Should You Lease And Then Buy A Car Bankrate

Getting Lease Tax Money Back From Government Ask The Hackrs Forum Leasehackr

California Lease Tax Question Ask The Hackrs Forum Leasehackr

Do Auto Lease Payments Include Sales Tax

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

California Vehicle Tax Everything You Need To Know

Ending Your Car Lease Is Tricky But Can Still Pay Off Cleveland Com

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet